These tools tell us about trends, but

they do not help us understand the character

of a the trend. Is the trend weak, or

strong, or stable, or volatile? The Guppy

Multiple Moving Average indicator helpd to

understand this character of the trend

because it captures the changing differences

between price and value.

A crossover delivers two messages about the

market. The first, and most commonly

understood, is a message about price.

Today’s price is higher, or lower, than the

average price over two time frames.

The second message is about value. At the moment in time when the two averages crossover there is a fleeting agreement about the value of the stock. Price is what we pay for a stock and value is what we think the stock is worth.

Generally we try to get stock at a price that is below what we believe is its true value. Changes in value drives the market. As soon as there is agreement about value, then we can expect disagreement. It is human nature.

Imagine a popular newsletter recommended stock XYX as an excellent, sure fire, cannot fail, buy at $1.50. The market is closed and the last traded price for XYX was $1.50. If you wanted to buy XYX tomorrow on the open, would you bid $1.50 knowing that many other people had also read the same newsletter?

With such widespread agreement on value from the people who read the newsletter, you need to bid $1.52 just to get ahead of the crowd. Other readers bid even higher, just to be sure of getting stock. Still others will watch the open of the market, perhaps at $1.55, and then bid ahead of the market at $1.58 to get the stock.

The key point is that where there is

agreement in the market about value, it is

usually followed by disagreement.

We see this in action when we take a group

of moving averages. We assemble a group of

3, 5, 8, 10, 12, and 15 day exponential

moving averages to track this short term

traders think. We cannot know for certain

that these are short term traders, but it

provides a guide to short term movements in

the market. It is convenient to think of

these as representing traders.

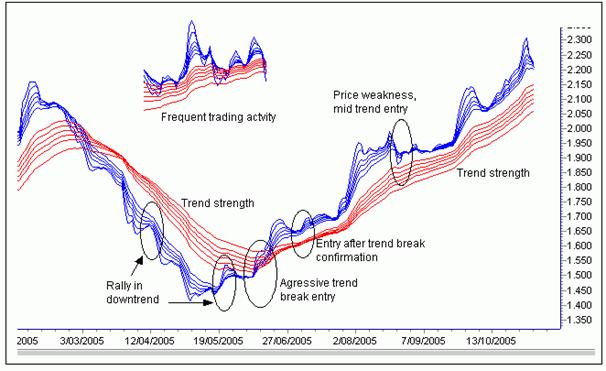

The chart shows two characteristics. When

there is widespread agreement amongst

traders about value - when the averages all

converge – it is often followed by an

explosive move as the moving averages start

to move apart. Traders outbid each other to

get hold of stock.

This is the second characteristic of the

chart display. When the averages are very

wide spread - when people get too carried

away about the price of a stock when

compared to value - the price collapses.

This type of chart shows bubbles of short

term excitement.

The market is driven by two groups – traders

and investors. Investor activity provides

stability in a trend so if we can understand

their behaviour we can make a better

decision about the strength of the trend.

We track the inferred behaviour of

investors using a group of 30, 35, 40, 45,

50 and 60 day exponential moving averages.

We see the same pattern with this group.

Think of these as six fund managers. They

all decide the stock is worth adding to

their portfolio. The only way they can get

stock is to outbid their competitors.

Because they often want very large blocks of

stock, they have no choice but to pay a bit

more than the current market price.

To put their analysis into action they have to buy stock on the open market and beat their competitors. The common agreement on value is shattered when they start buying stock. Just like traders, when investors agree about value, it is followed by a disagreement about value. And, at the point of maximum disagreement, the price collapses. Their activity is a fractal repetition of the activity of the traders.

As the chart shows, when we track the

implied activity of both groups - traders

and investors - the Guppy Multiple Moving

Average indicator is particularly useful for

identifying major shifts in the trend. When

both groups converge and agree about value,

then this is a signal for a very major

change or acceleration in the trend. When

only one group gets carried away - usually

the traders - we know how much impact they

are likely to have because the Guppy

Multiple Moving Average shows us where the

long term agreement of values lies.

In more advanced application of the Guppy

Multiple Moving Average the relationship

between each of the groups is used to help

determine the type of trading opportunity.

It is also used to evaluate the potential

for a trend break to succeed. These aspects

assist traders in making better decisions

about the best trading approach to use with

each opportunity.

This

powerful tool helps traders to understand

the mood of the market. Unlike just two

moving averages, what is important is not

the price reading, but the relationship

between the way the two groups value the

stock in the current market.