| OmniTrader -

back testing your strategies

[Other

Examples] |

- This is an

example using IPL (a company with a long term trending history until

recently, when it crashed).

- Firstly this

stock was selected because its a trending stock without much

volatility - this is critical given the trade plan in this example

was to only purchase this type of share.

- The analysis

uses two

strategies and only selects "Long Positions" (i.e. the strategy modules

were modified to only

activate longs not shorts).

- The strategies

used are "Guppy-Darvas" and the "Wave Trending" strategy.

- In the

simulation each long

position was then purchased and sold as suggested by the simulation

without modification.

- The outcome was

a 46% return over a year - lets look at this in more detail

|

|

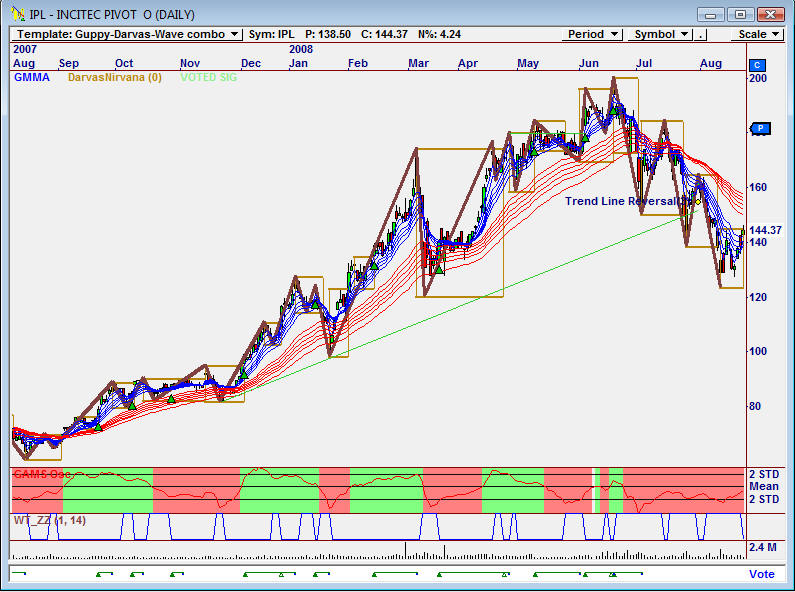

OmniTrader - 12

month chart -

showing Guppy-Darvas-Wave Strategy - note the vote signals at the bottom

of the chart |

|

|

|

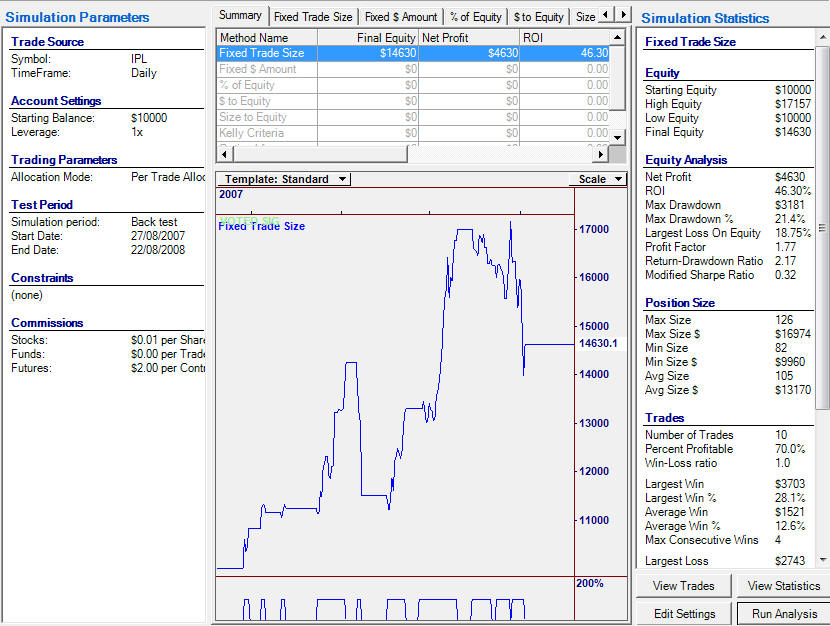

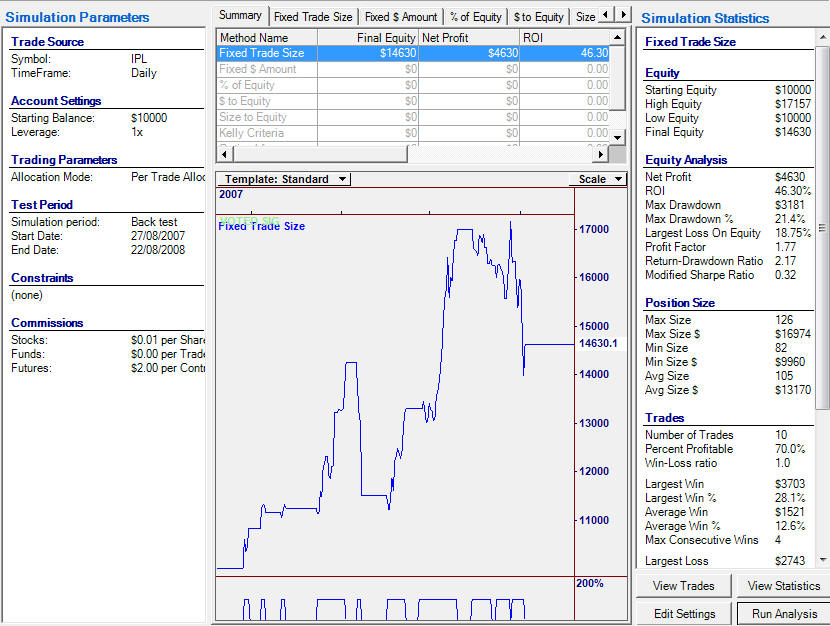

The Portfolio simulator

was then run

using these two strategies, and a "Fixed Trade" size (which is

one of the many options available in the simulator)

- the graph shows

the equity curve (the original capital plus cumulative

profits/losses) and the details of the analysis

- The key point is

that on the $10,000 capital resulted in a profit of $4630 or 46%.

- There are some

losses where the equity curves falls - these losses could have been

reduced by modifying the strategy to identify an earlier exit.

- This is why you

should use test your strategies in the simulator to see if you can

modify the strategy to get a better result, or add additional profit

stops.

- For more information

on how to do this, use the online

Tutorial inside OmniTrader 2008.

-

You can also order the seminar

CD - Mastering Money Management which explains this in more

detail.

|

|

|

|

|

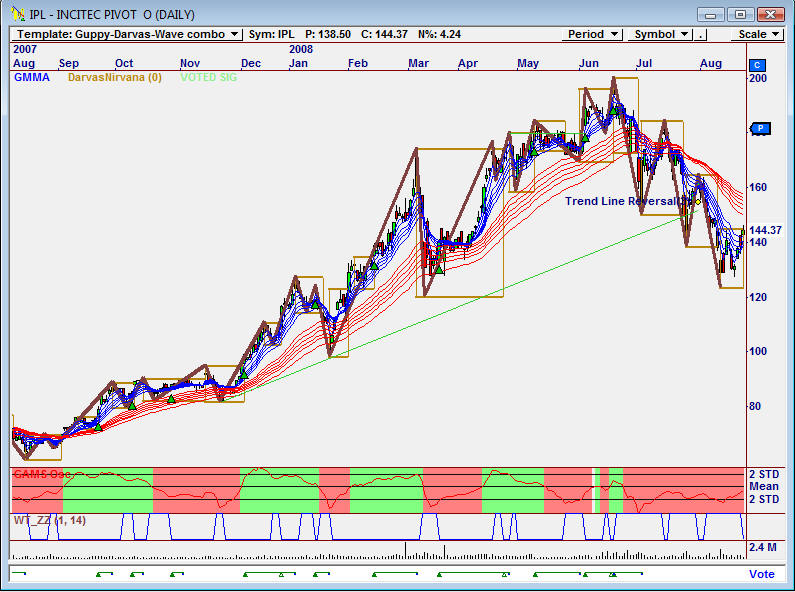

The following is the schedule of actual trades which were

automatically purchased by the system, and match the vote line.

The lesson here is that the strategy

allows losses to get to big when there is a fast fall in share price |

|