- GroupTrader is designed to take advantage of a phenomenon called group rotation.

- Group rotation is the tendency for institutional traders to exert buying or selling pressure within an industry group, pushing the prices of securities within a group either higher or lower relative to the general market. In this case, the industry group will often lead or lag the market and many of the securities in the industry group will follow.

- GroupTrader is designed to take advantage of these rotations, helping you identify them and trade with the rotation. One of the factors that can cause a group rotation is the release of fundamental news that implies higher prices ahead. The institutional investors and mutual fund managers often reason that this news will be good for the entire sector so they buy securities in the industry groups that make up the sector.

- When other institutional investors and mutual fund managers see this movement, they start buying in that sector as well. Soon, many investors are buying and will continue to buy until the bullish sentiment fades and a correction occurs in the market.

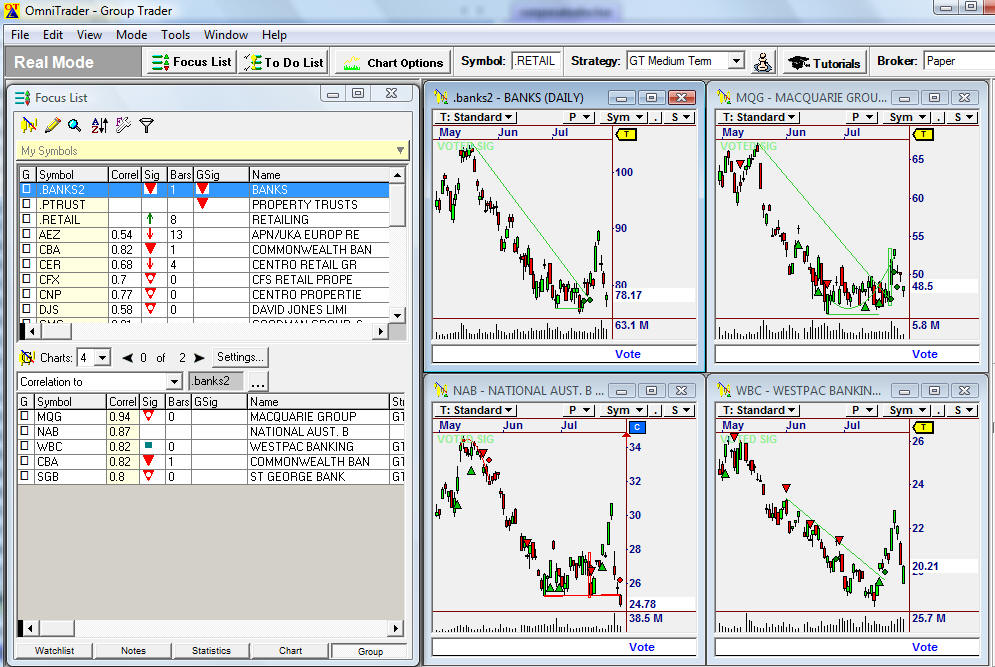

- GroupTrader helps you get into a trade when it is on the move by identifying and confirming these moves in the market.

- The correlation statistic measures how well a stock correlates to (or mirrors) the industry group to which it belongs.

- GroupTrader uses the correlation results to generate consensus signals in the Focus List. You will notice that some industry groups are highly correlated and some are not. This means that some securities tend to move up and down in harmony with the group while other securities move erratic, relative to the group.